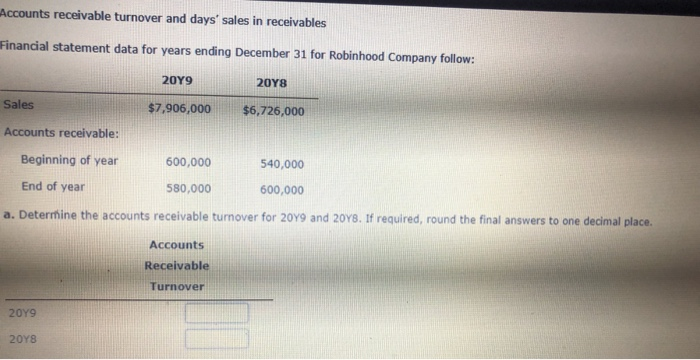

Number of days sales in receivables ratio 247830-How to calculate the number of days sales in receivables

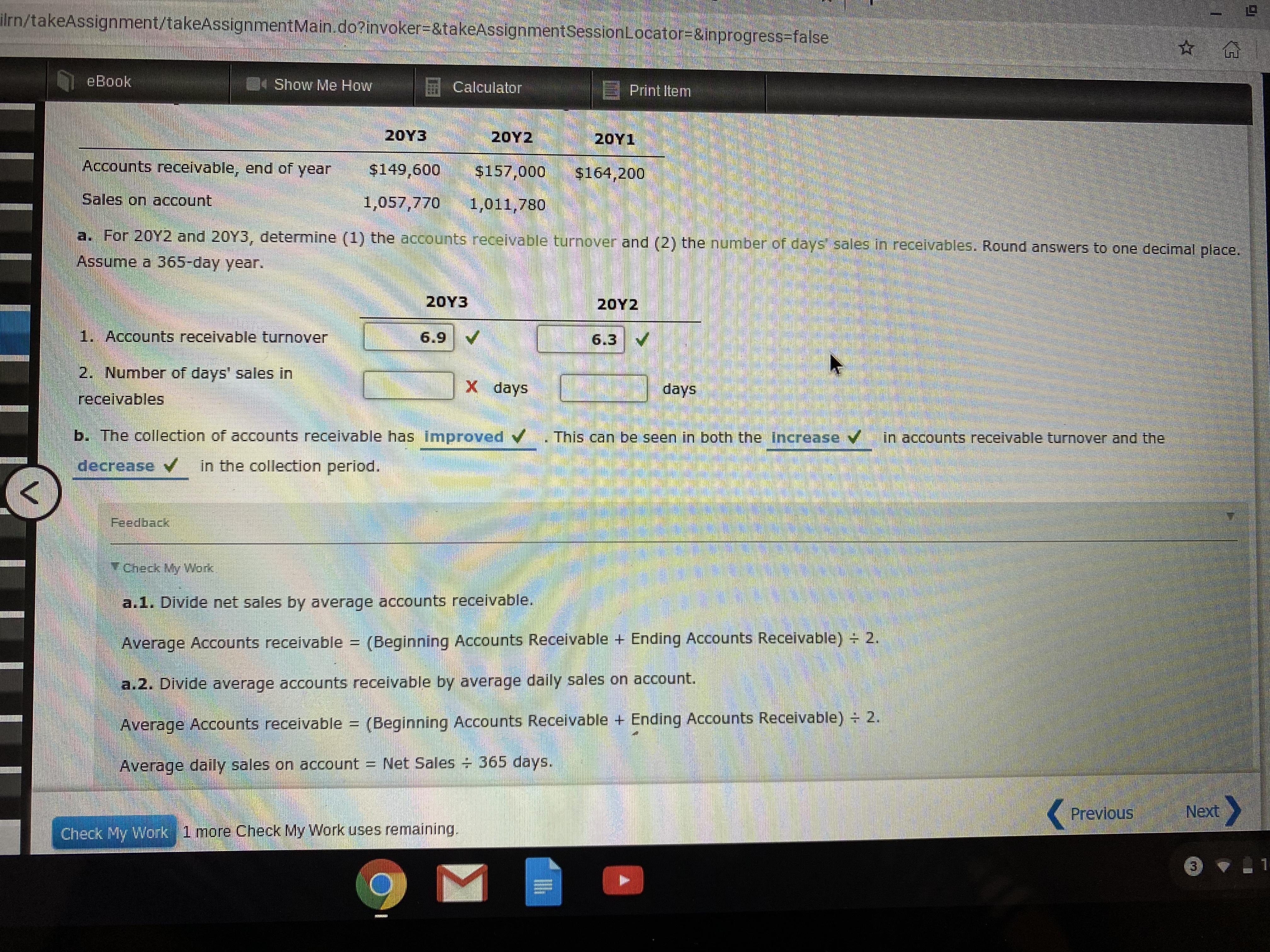

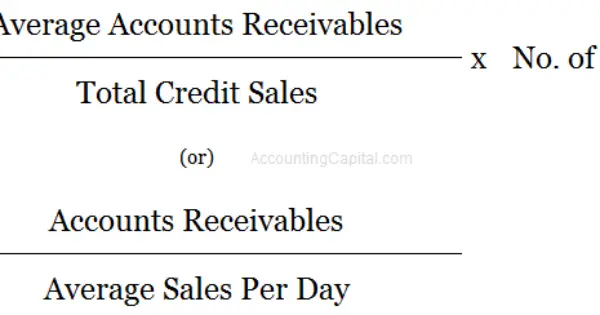

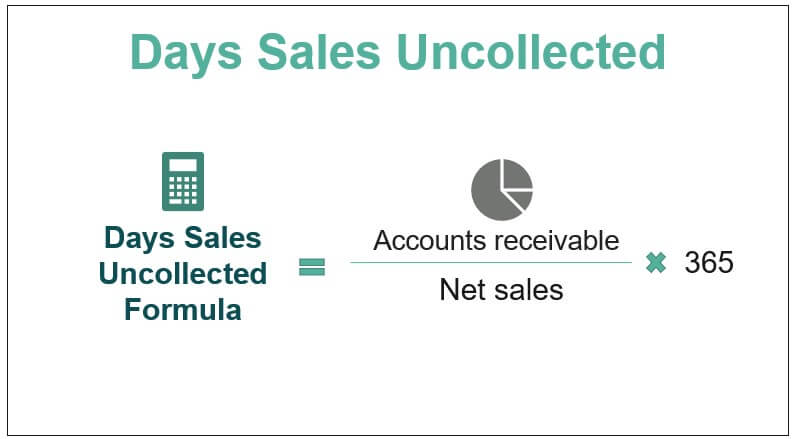

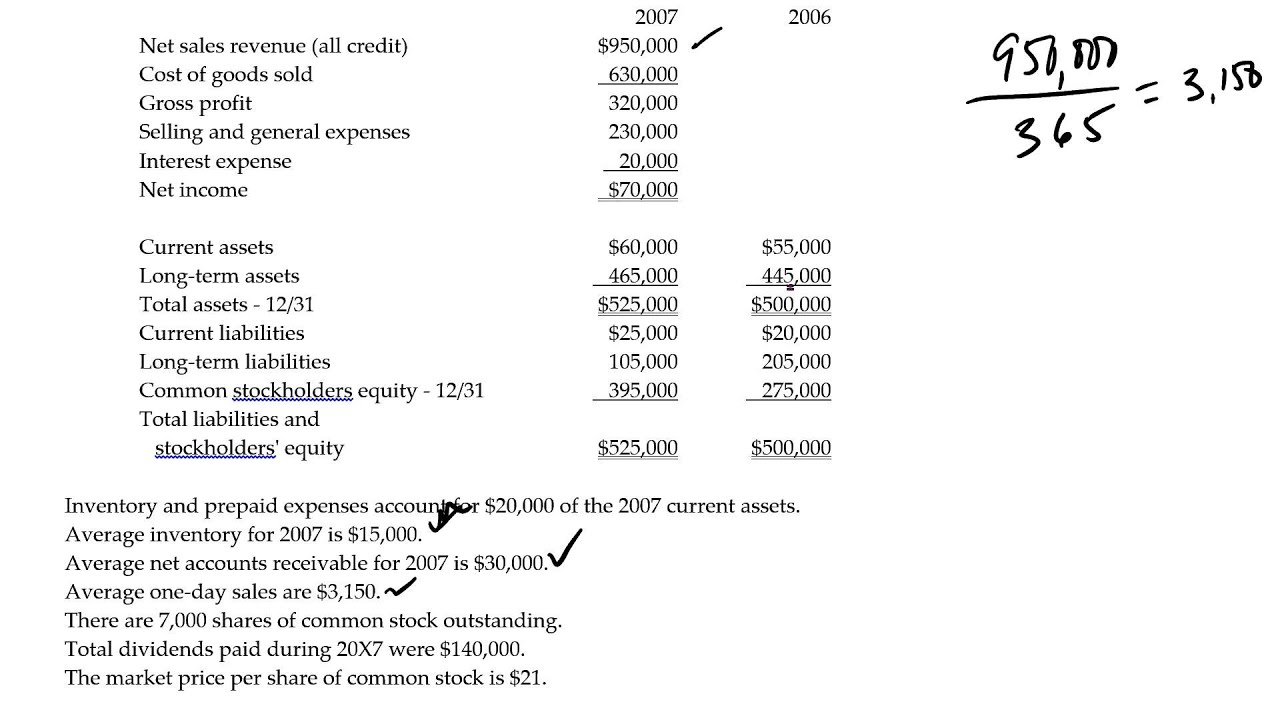

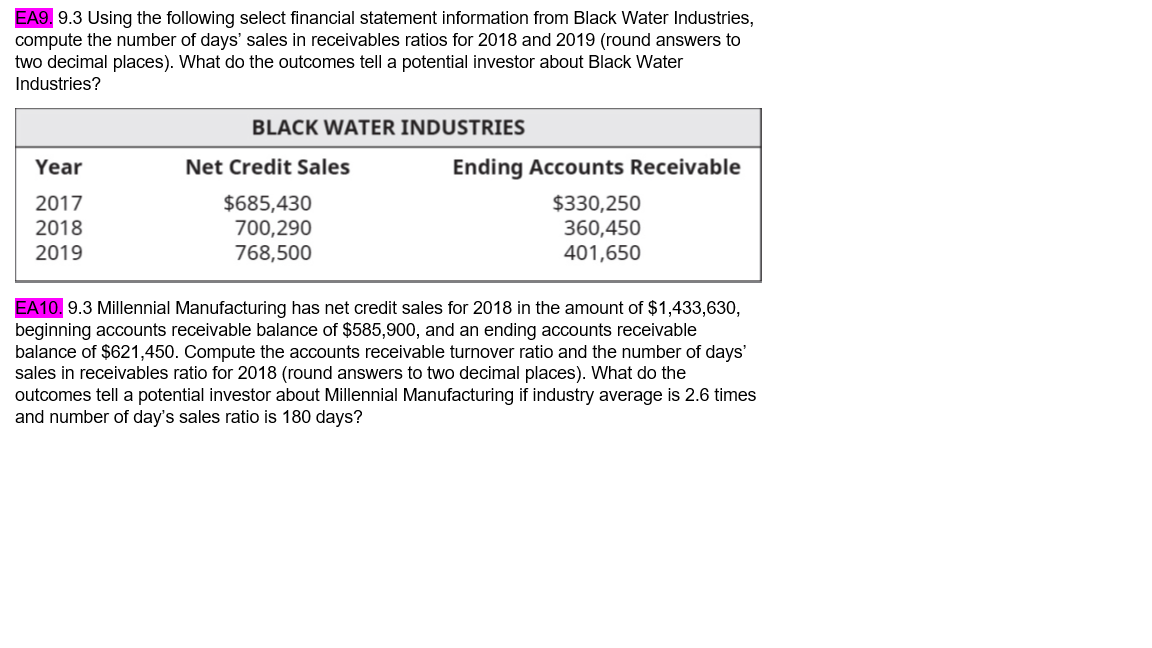

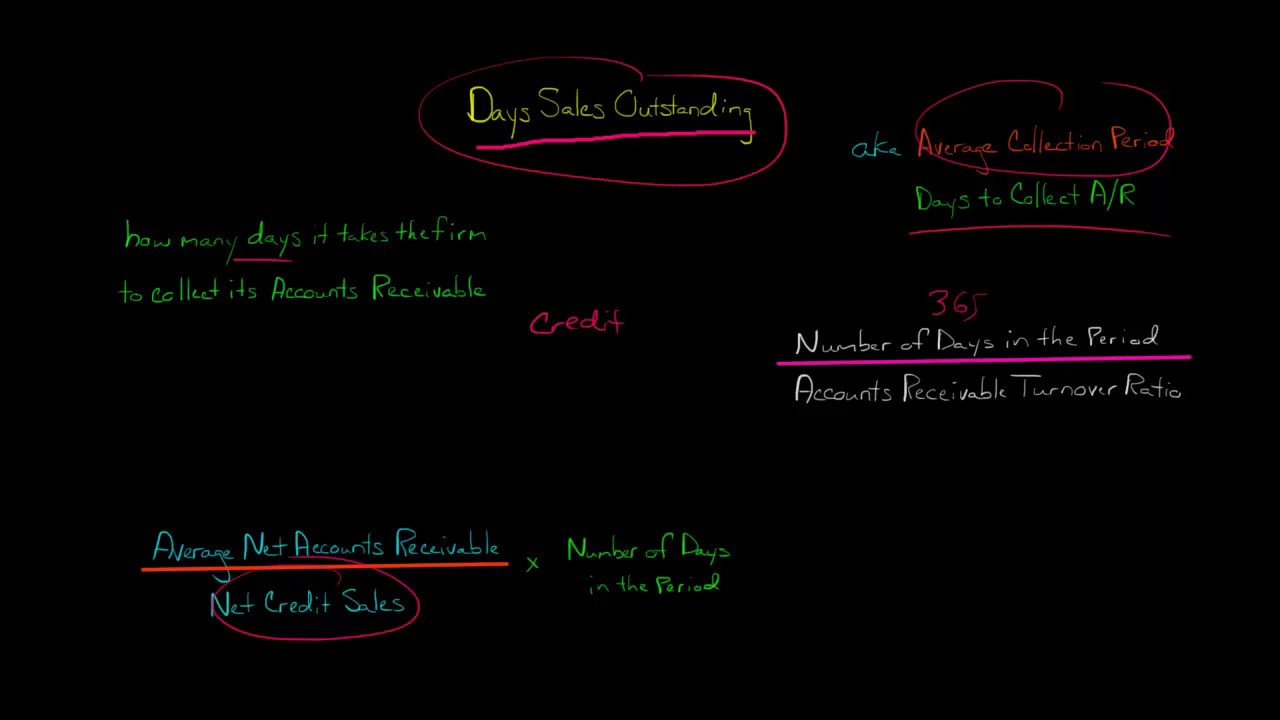

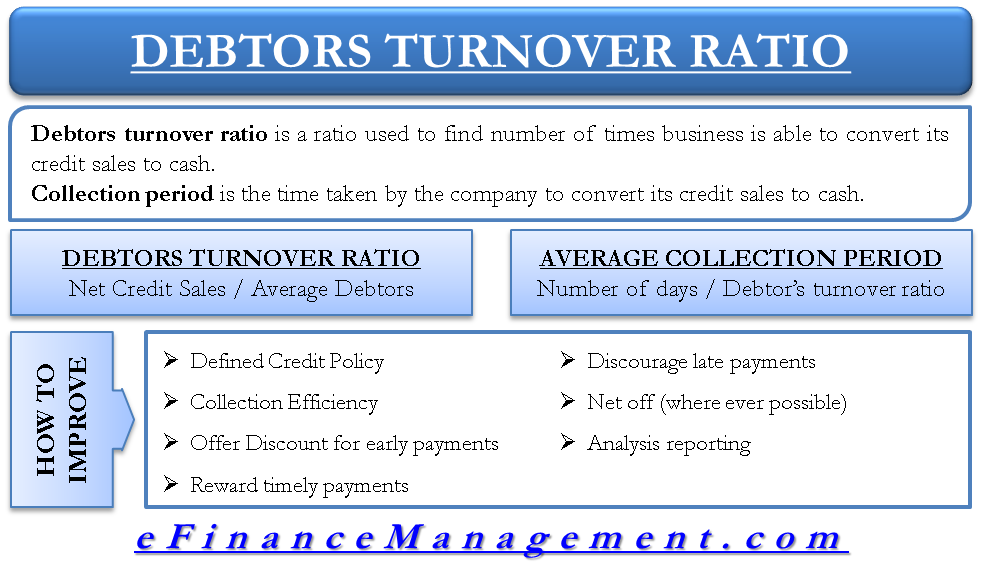

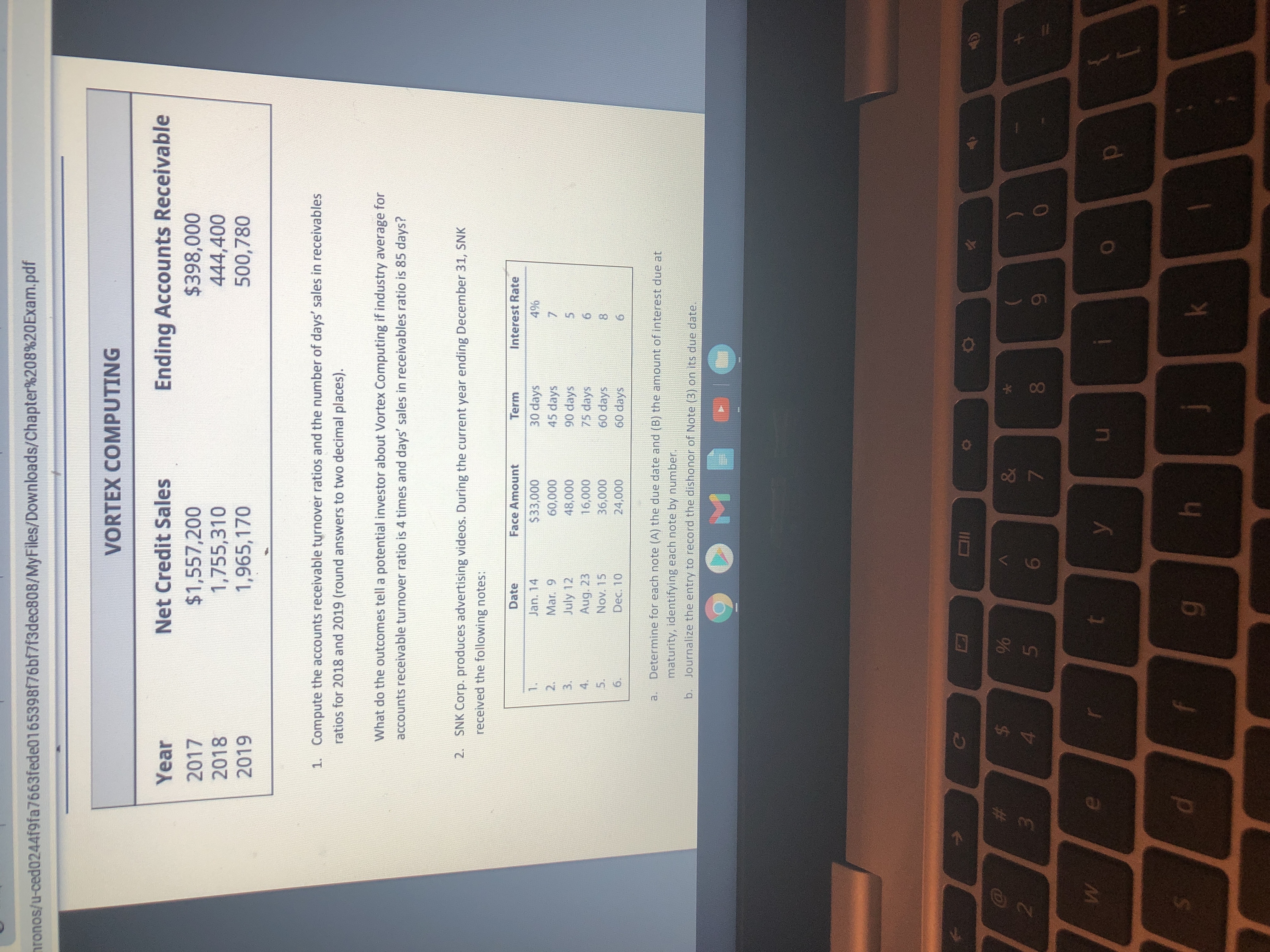

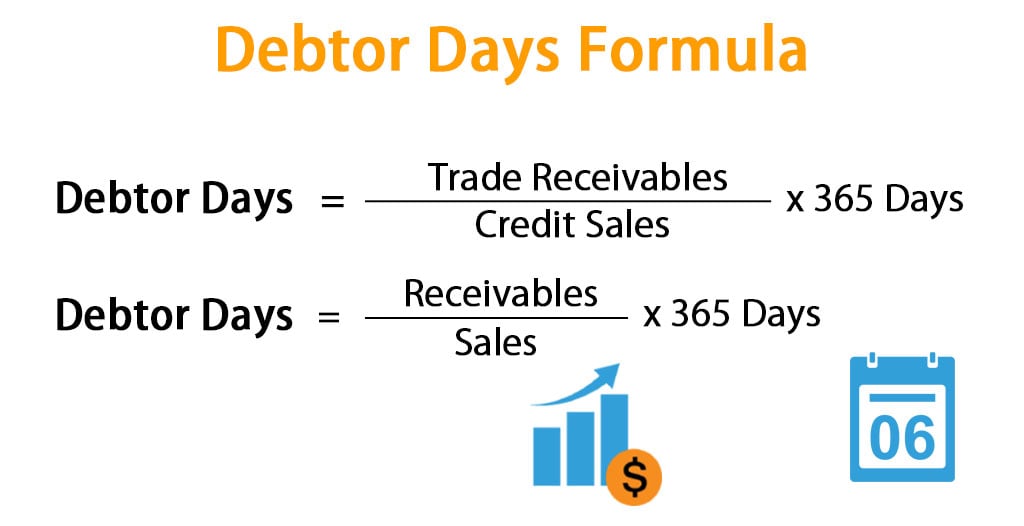

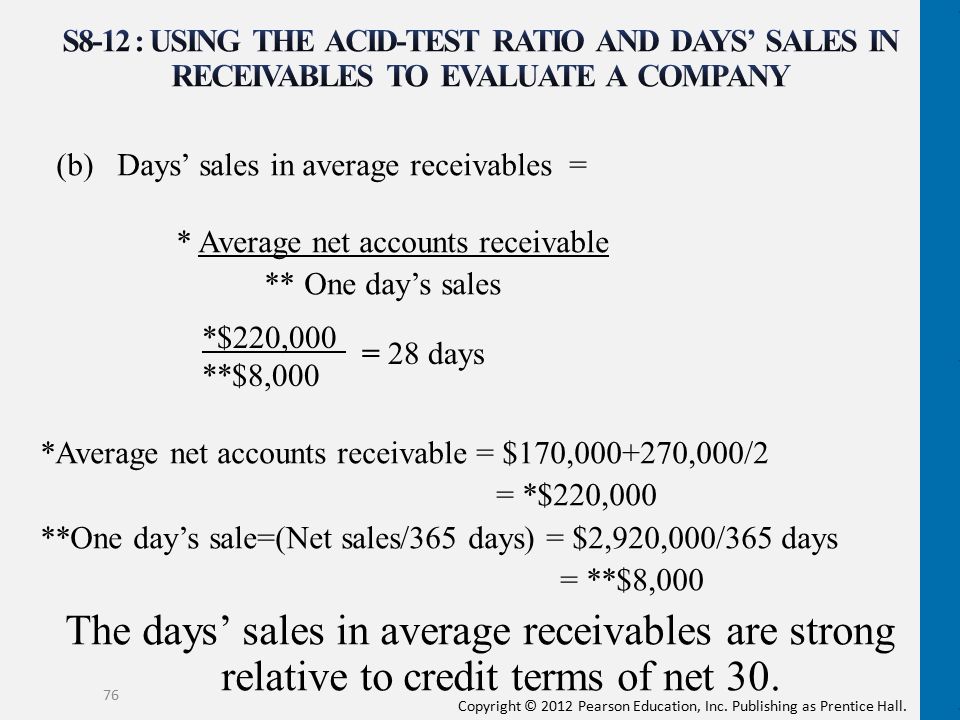

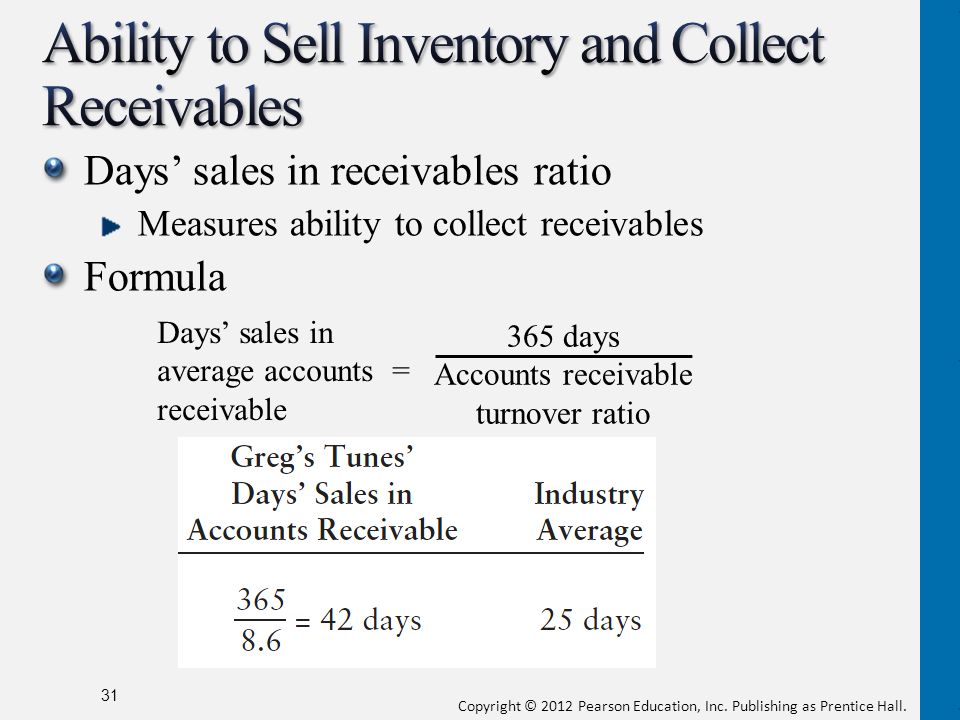

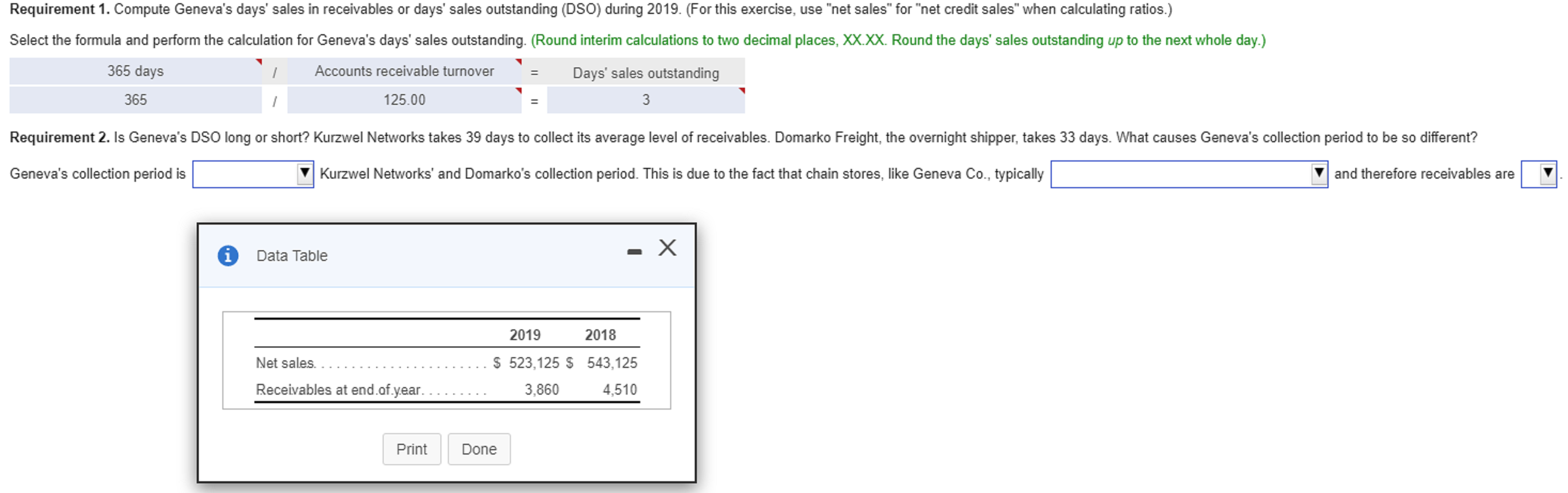

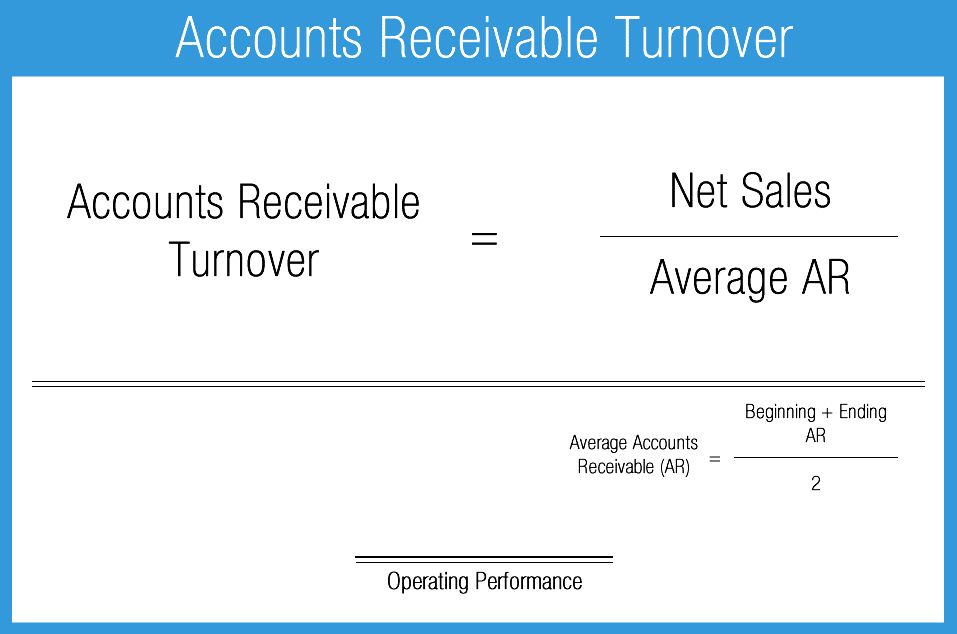

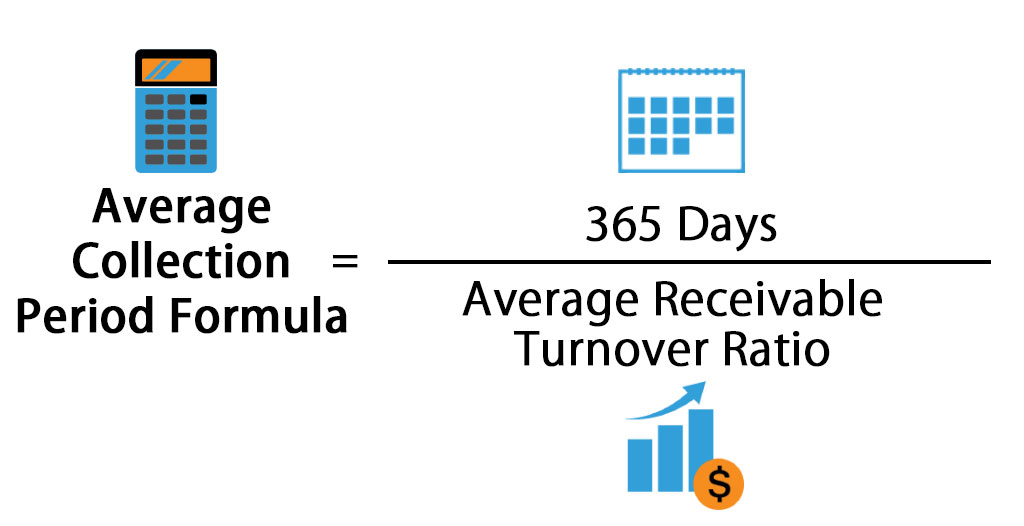

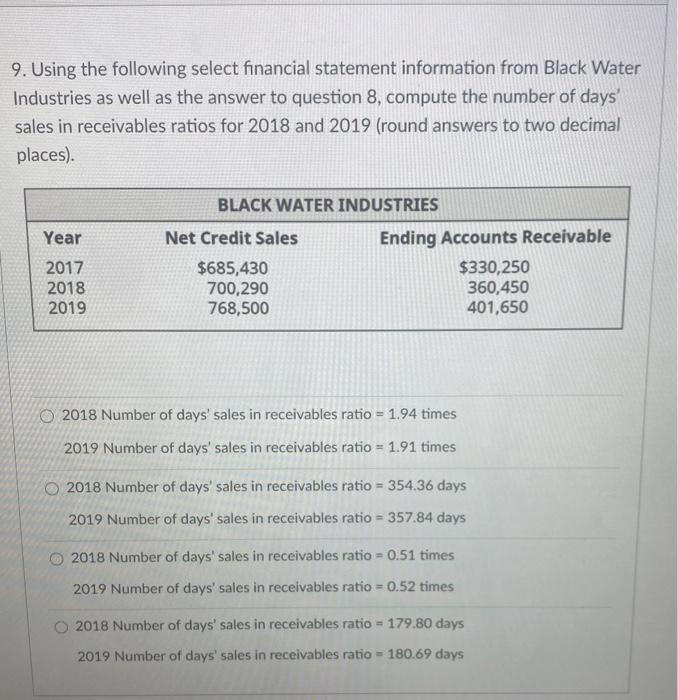

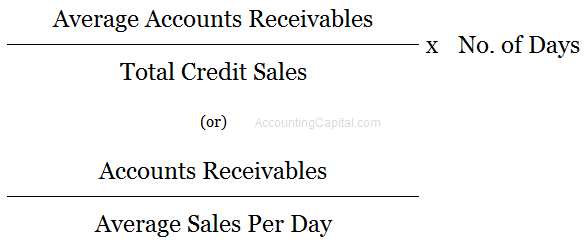

Receivables Collection Period Average Accounts receivable x 360 Sales The days' sales in receivables measure the number of days it takes, on average to collect accounts receivable based on the yearend balance in accounts receivable This ratio can assess the extent of customers paying on time If the average collection period increases fromThe ratio to determine number of days' sales in receivables is as follows The numerator is 365, the number of days in the year Because the accounts receivable turnover ratio determines an average accounts receivable figure, the outcome for the days' sales in receivables is 59 Conceptually, what does the days' sales in receivables ratio measure for a firm?

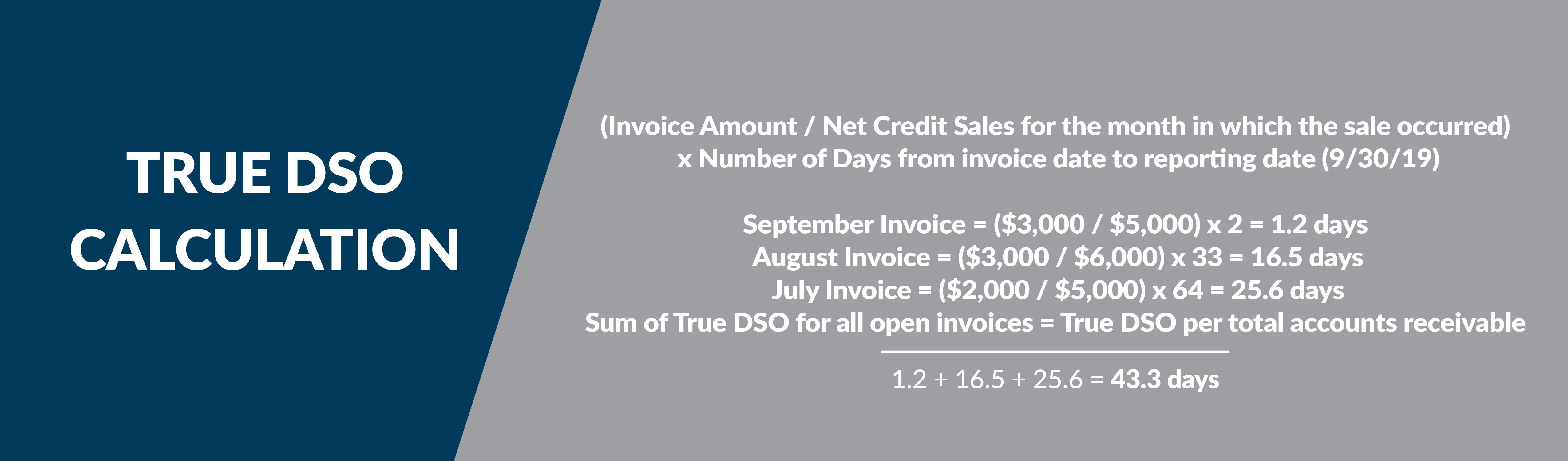

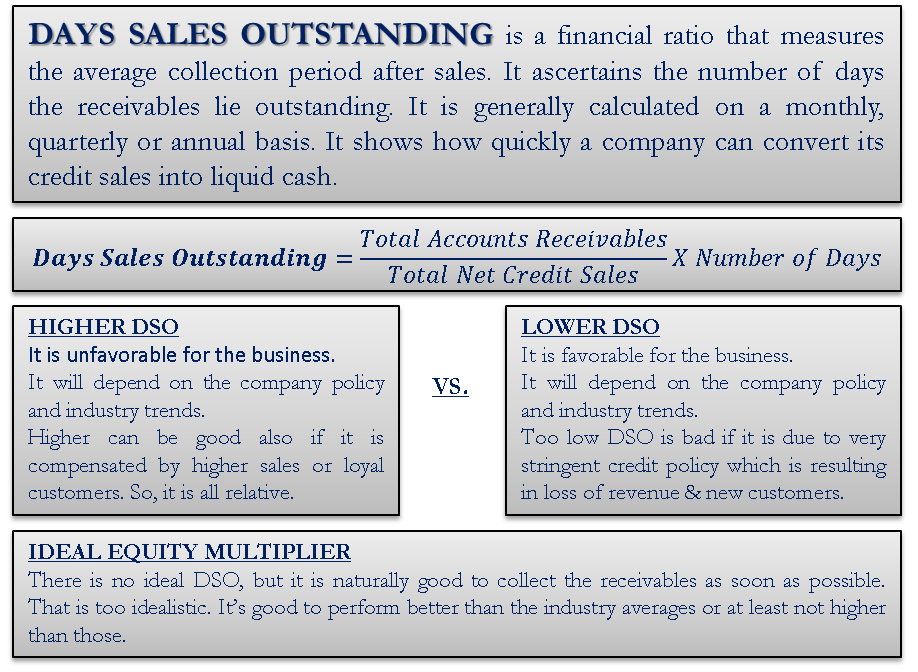

What Is Dso Why Dso Is Vital For Accounts Receivable Billtrust

How to calculate the number of days sales in receivables

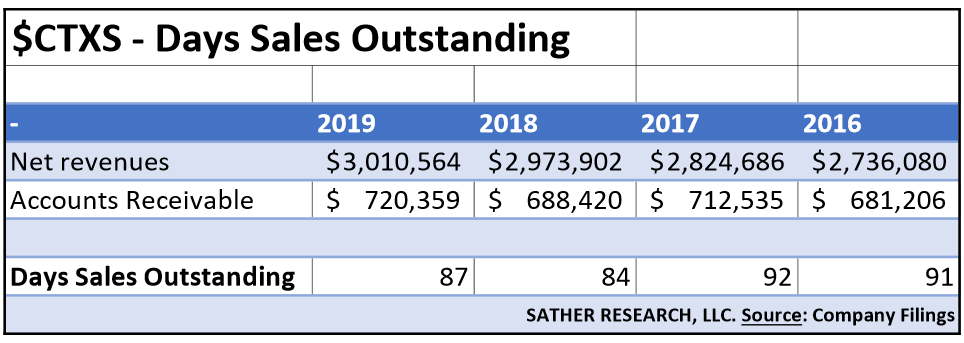

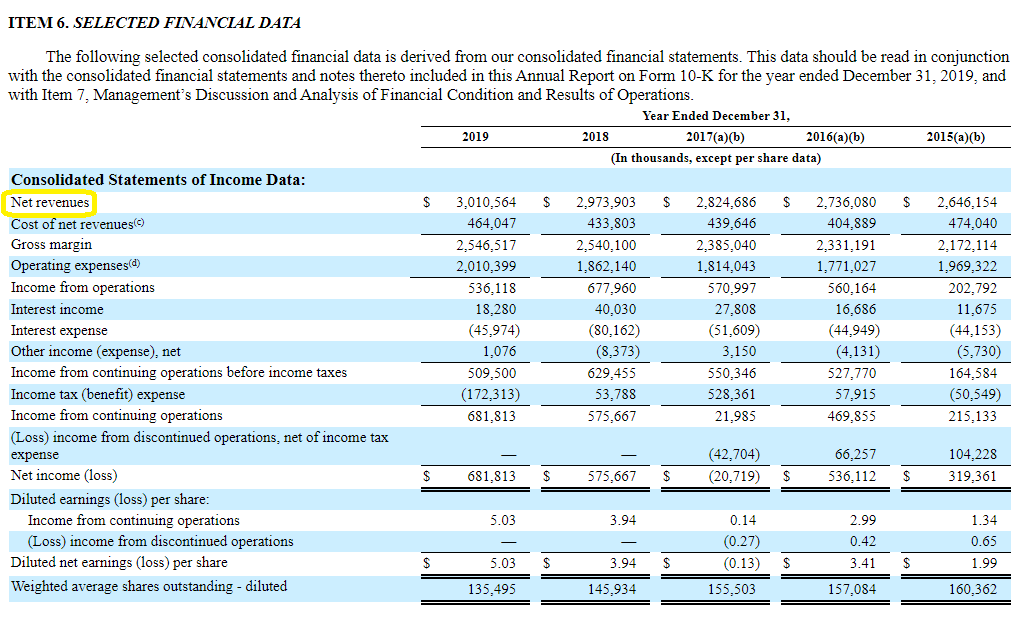

How to calculate the number of days sales in receivables-Receivables Turnover and Days of Sales Outstanding (DSO) CFA® Exam, CFA® Exam Level 1, Financial Accounting, Financial Management This lesson is part 3 of 9 in the course Financial Ratios Receivables turnover is an important activity ratio, and provides a measure of how effectively a business is managing its receivablesCurrent and historical days sales in receivables for VeriSign (VRSN) from 06 to 21 Days sales in receivables can be defined as the average number of days it takes to collect outstanding receiveable amounts from customers VeriSign days sales in receivables for the three months ending was

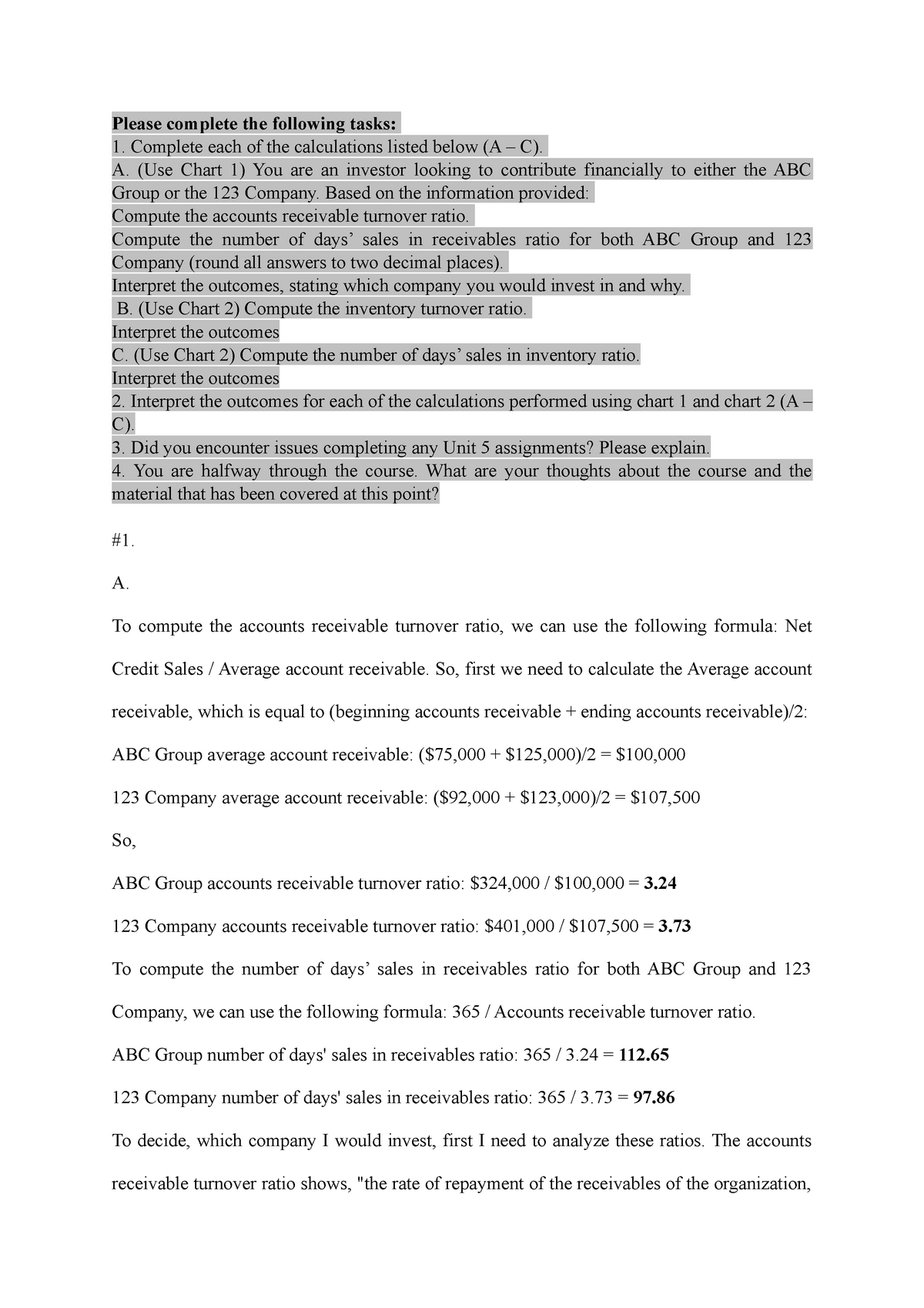

1

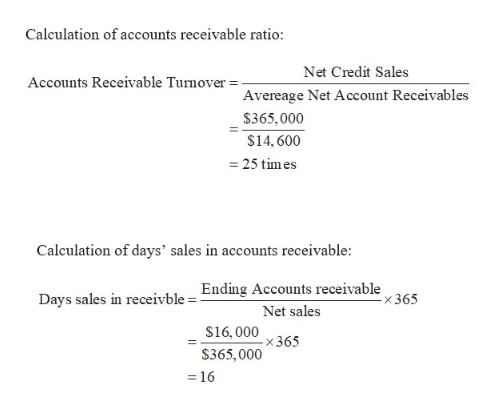

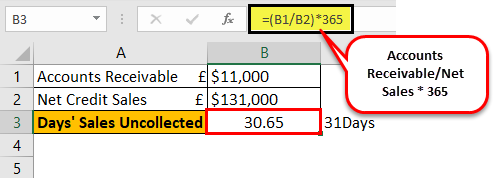

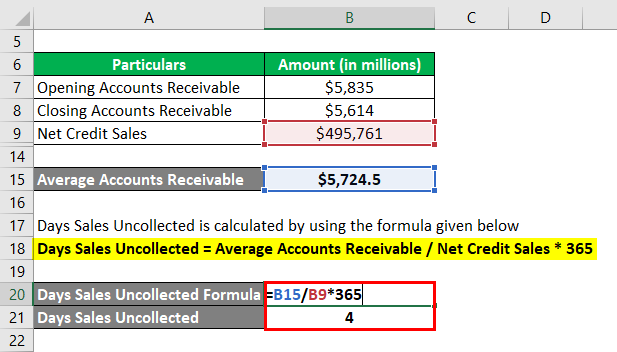

Accounts Receivable Turnover Ratio = $100,000 $10,000 / ($10,000 $15,000)/2 = 72 In financial modeling, the accounts receivable turnover ratio is used to make balance sheet forecasts The AR balance is based on the average number of days in which revenue will be received Revenue in each period is multiplied by the turnover days and Days' sales uncollected is a liquidity ratio that is used to estimate the number of days before receivables will be collected This information is used by creditors and lenders to determine the shortterm liquidity of a company It can also be used by management to estimate the effectiveness of its credit and collection activitiesCollection of receivables is quick, and cash can be used for other business expenditures South Rims has an accounts receivable balance at the end of 18 of $357,470 The net credit sales for the year are $769,346

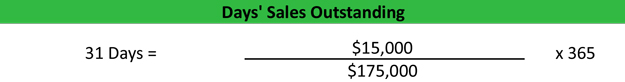

The days sales outstanding formula is as follows Divide the total number of accounts receivable during a given period by the total value of credit sales during the same period and multiply the An activity ratio equal to the number of days in the period divided by inventory turnover over the period Target Corp's number of days of inventory outstanding improved from 19 to and from to 21 Average receivable collection period An activity ratio equal to the number of days in the period divided by receivables turnover A The number of days it takes to generate dollar sales equal to the outstanding accounts receivable balance OB The number of days it would take to collect outstanding receivables if no new ones are created OCThe number of days it takes for a firm to pay its bills assuming not new payables are created D

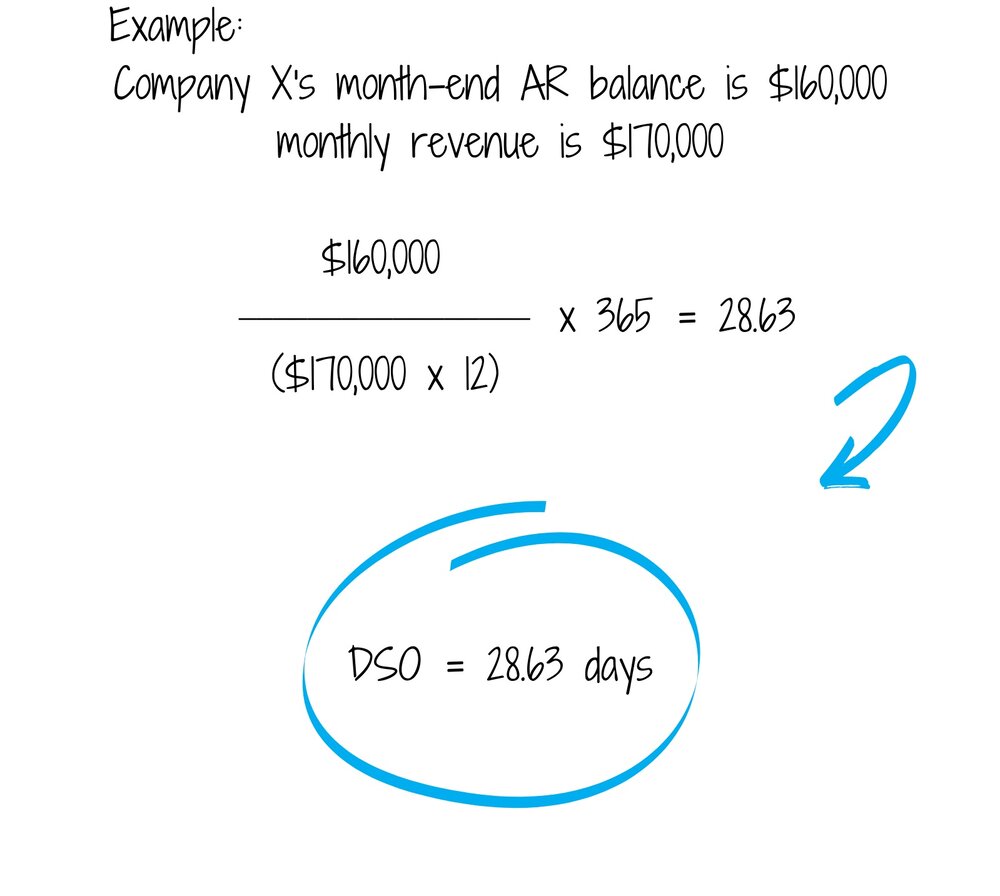

Return On Tangible Equity Current and historical days sales in receivables for Tesla (TSLA) from 09 to 21 Days sales in receivables can be defined as the average number of days it takes to collect outstanding receiveable amounts from customers Tesla days sales in receivables for the three months ending was 1637 DSO = (accounts receivable) / (total credit sales) x (number of days in given time period) In the formula, the accounts receivable is divided by the credit sales for a specified number of days, and then multiplied by that number of days The result is the days sales average, which can give insight into how a business generates cash flowThe turnover rate will increase if the receivables balance decreases or the sales revenue increases Therefore, when the turnover rate increases, the number of

What Is The Accounts Receivable Days Formula Gocardless

Days Sales Outstanding Dso Knowledge Center And Forum 12manage

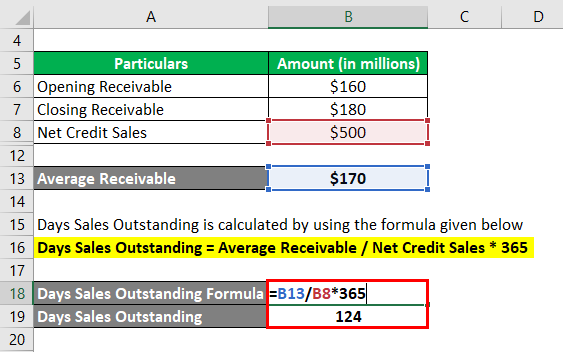

To get your DSO calculation, first find your average A/R for the time period The average between $25,000 and $,000 is $22,500, so this is your Average A/R The next number you'll need is your Total Credit Sales, which was given as $45,000 Lastly, determine the number of days in the period Days Sales in Receivables The average number of days it takes to collect outstanding receivable amounts from customers Calculated as Number of Days in Period / Receivable Turnover Ford Motor Company (F) had Days Sales in Receivables of 2869 for the most recently reported fiscal year, endingIf a company generates a sale to a client, it could extend terms of 30 or 60 days, meaning the client has 30 to 60 days to pay for the product The receivables turnover ratio measures the

Answered Ilrn Takeassignment Takeassignmentmain Bartleby

What Does The Days Sales In Receivables Ratio Chegg Com

Interpretation Days Sales Outstanding shows how long it takes for a business to recover the revenue receipts from its trade receivables Using the example above, for instance, we can conclude that during the year ended 30 June X5 it took HIJ PLC an average of 15 days to collect revenue receipts from its trade debtors Example of Accounts Receivable Days If a company has an average accounts receivable balance of $0,000 and annual sales of $1,0,000, then its accounts receivable days figure is = 608 Accounts receivable days The calculation indicates that the company requires 608 days to collect a typical invoice How to Reduce Accounts Receivable Days The number of days' sales in receivables ratio shows the expected number of days it will take to convert accounts receivable into cash The ratio is found by taking 365 days and dividing by the accounts receivable turnover ratio

1

1

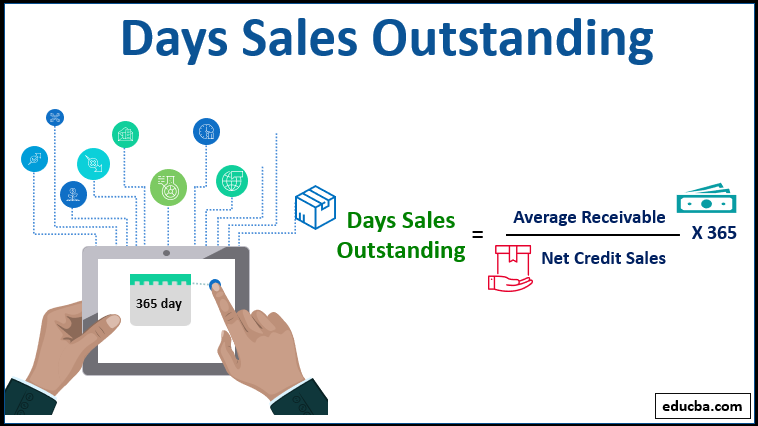

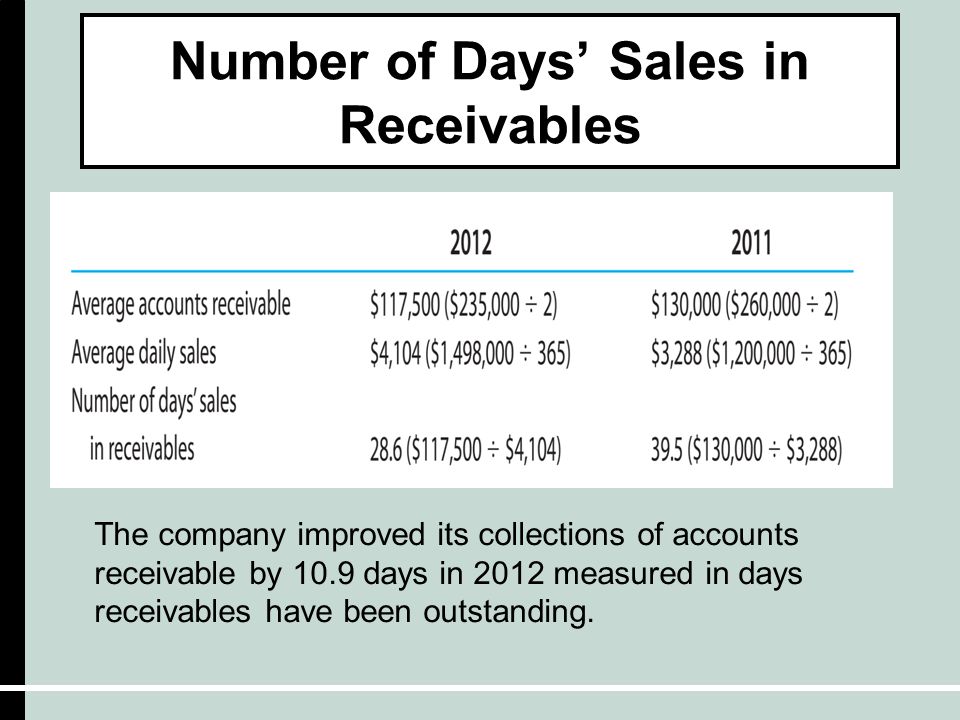

Days of Receivables= (Average Accounts Receivable/Credit Sales) *365 Say for instance, a company A is due to receive Rs 3 lacs out of a credit sales of Rs 10 lacs, then days of receivables would be 3/10*365 which is 1095 days which means it will realize its entire sales in 1095 days Accounts Receivable Turnover in Days The accounts receivable turnover in days shows the average number of days that it takes a customer to pay the company for sales on credit The formula for the accounts receivable turnover in days is as follows Receivable turnover in days = 365 / Receivable turnover ratio Add the two receivables numbers ($1,1,363 $1,178,423) and divide by two This results in average accounts receivable of $1,180,3 Now you have the figures you need to calculate the equation Just plug the numbers in Credit sales ÷ average receivables = accounts receivable turns $15,608,300 ÷ $1,180,3 = accounts receivable turns

How To Calculate Days Sales Outstanding Dso Finance Friend

Days Sales Outstanding Examples With Excel Template Advantages

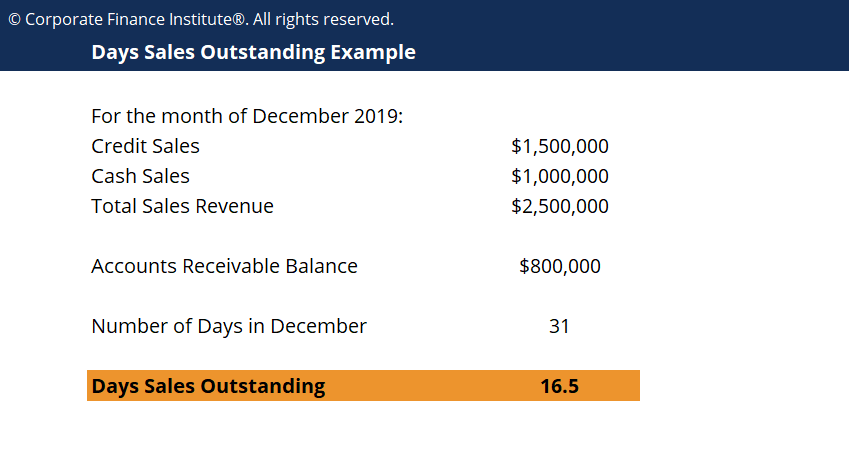

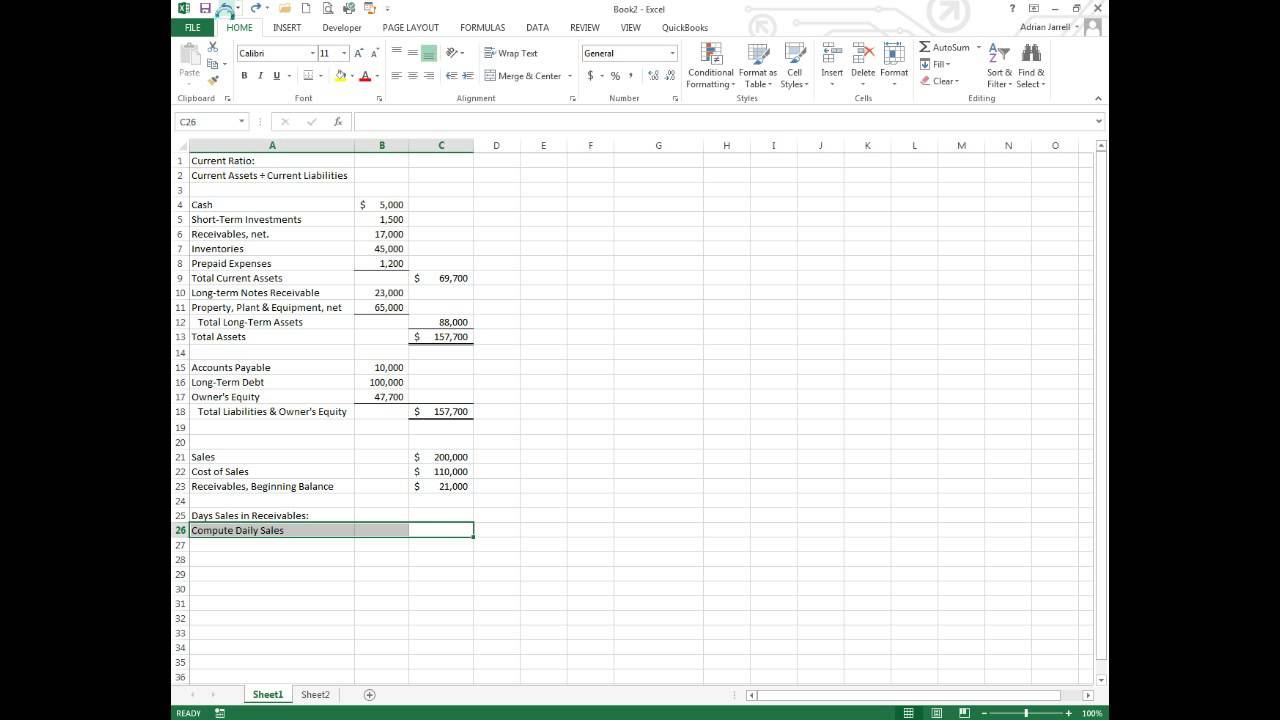

Accounts Receivable Turnover (Days) (Year 2) = 325 ÷ (3854 ÷ 360) = 30,3 Accounts Receivable Turnover in year 1 was 28,5 days It means that the company was able to collect its receivables averagely in 28,5 days that year In year 2 this ratio increased, indicating that the company needed 30,3 days to collect its receivables The accounts receivable balance as of monthend closing is $800,000 Given the above data, the DSO totaled 16, meaning it takes an average of 16 days before receivables are collected Generally, a DSO below 45 is considered low, but what qualifies as high or low also depends on the type of businessA) The number of days it takes to generate dollar sales equal to the outstanding accounts receivable balance B) The number of days it would take to collect outstanding receivables if no new ones are created C) The number of days it takes for a firm to pay its bills assuming no new

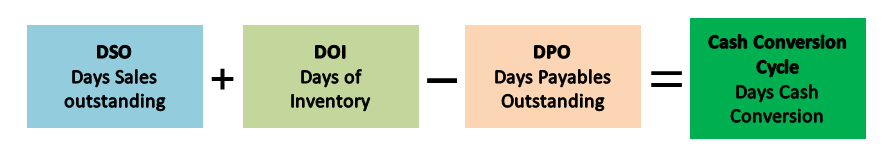

Cash Conversion Cycle Overview Example Cash Conversion Cycle Formula

What Is Days Sales Outstanding Dso Accountingcapital

When using this average collection period ratio formula, the number of days can be a year (365) or a nominal accounting year (360) or any other period, so long as the other data—average accounts receivable and net credit sales—span the same number of days How the Average Collection Period Ratio WorksMore_vert Which of the following best represents a positive product of a lower number of days' sales in receivables ratio?Days' sales in receivables estimates the average number of days it takes to a Collect cash sales b Collect accounts receivable c Convert inventory to sales d Convert raw materials to finished

Days Sales Outstanding Formula Meaning Example And Interpretation

A Look At The Cash Conversion Cycle

The business started the year with $7,600,000 million in account receivables and after 95 days the accounts receivables were $9,600,000 Net credit sales yeartodate were $24,300,000 With this information, he calculated the metric as follows Days of Sales Outstanding = (($7,600,000 $9,600,000)/2) / $24,300,000 * 365 = 129 days What does the days' sales in receivables ratio measure for a firm?Answer (D) is correct Turnover ratios are activity ratios that measure management s efficiency in using assets However the number of days sales in receivables (days in the year divided by the receivables turnover ratio), also known as the average collection period, and other turnover ratios are a measure of liquidity because these statistics

Accounts Receivable Turnover And Days Sales In Chegg Com

Days Sales Outstanding Formula Meaning Example And Interpretation

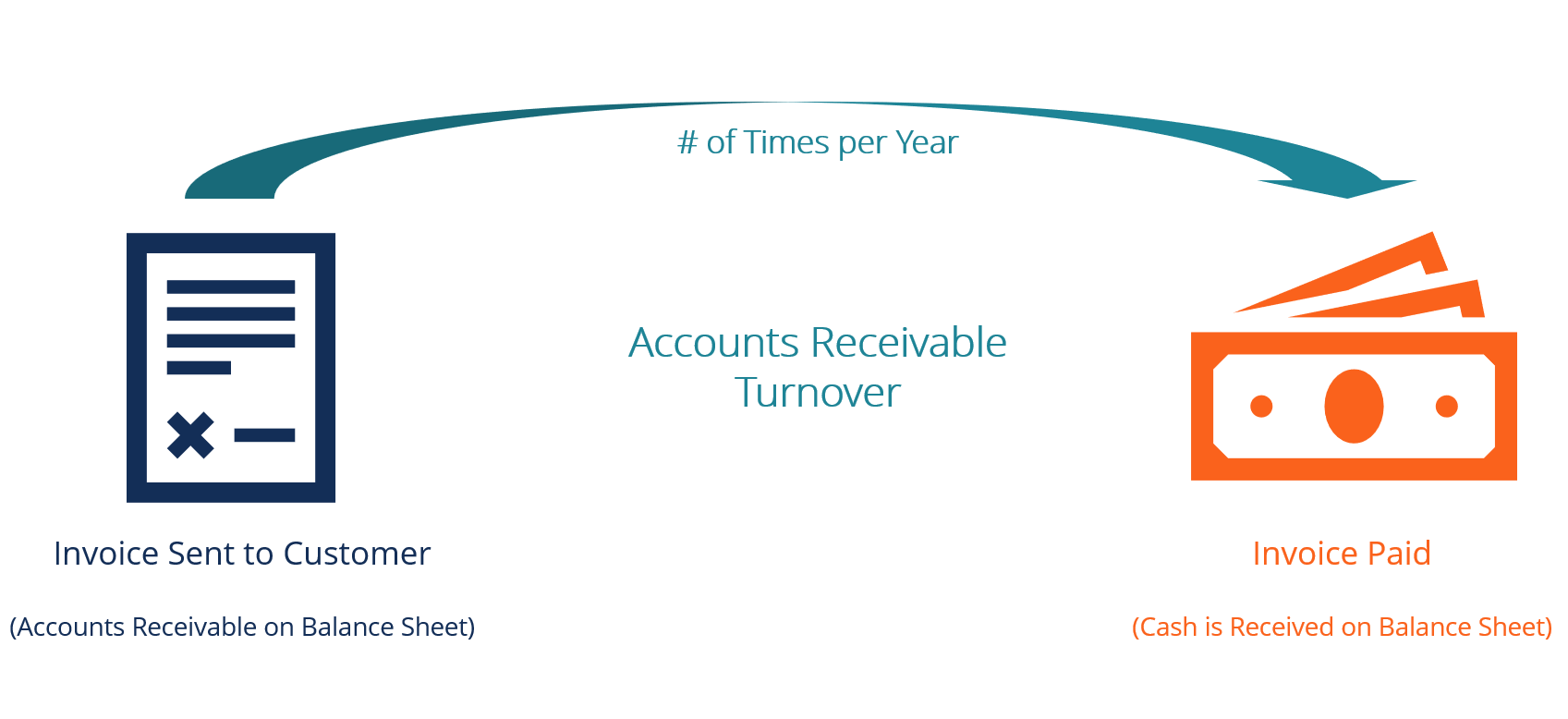

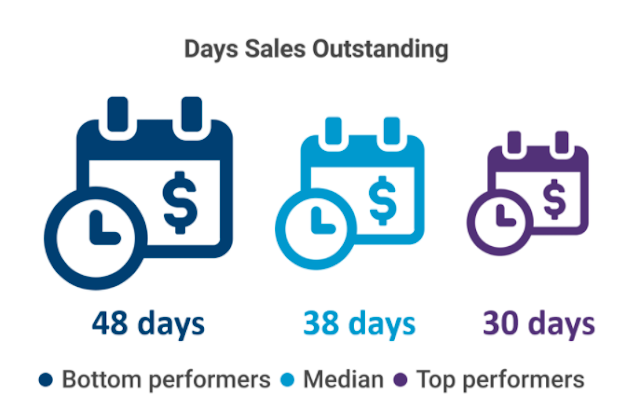

Accounts Receivable is the amount of money a company is due to receive This may be due to pending payments, sales on a credit basis, etcA company needs to monitor its Accounts Receivable as it is a source of cash inflow for the company Accounts Receivable is indicated as an asset in the balance sheet of the company and is expected to turn in cash over a yearAccounts Receivable Days = (Accounts Receivable / Revenue) x 365 Let's look at an example to see how this works in practice Imagine Company A has a total of $1,000 in their accounts receivable, along with an annual revenue of $800,000 Then, you can use the accounts receivable days formula to work out your total as followsThe Days Sales Outstanding (DSO) ratio is computed (in days) as follows Receivables Collection Period (Days Sales Outstanding) = Accounts Receivable / Credit Sales x 365 The collection period (DSO) can be compared to the company's credit terms to get an indication of the quality of the receivables

4 Ways To Reduce Your Company S Days Sales Outstanding Dso Receeve Gmbh

F Xzppblgjkxnm

Which of the following best represents a positive product of a lower number of days' sales in receivables ratio?D Number of days' sales in inventory C Allowance for uncollectible accounts as a percent of receivables when a company records fictitious receivables, this ratio increases D Operating profit margin a dramatic decrease in this ratio could indicate fraudA collection of receivables is quick, and cash can be used for other business expenditures B collection of receivables is slow, keeping cash secured to receivables C credit extension is lenient D the lender only lends to the top 10% of potential creditors

Chapter 8 Receivables Learning Objectives 1 Define And

Days Sales Outstanding Double Entry Bookkeeping

Shortterm activity ratio Description The company Average receivable collection period An activity ratio equal to the number of days in the period divided by receivables turnover Amazoncom Inc's number of days of receivables outstanding deteriorated from 18 to 19 but then improved from 19 to exceeding 18 levelDays sales in receivables can be defined as the average number of days it takes to collect outstanding receiveable amounts from customers Starbucks days sales in receivables for the three months ending was 11 Compare SBUX With Other Stocks Starbucks Days Sales in Receivables Historical Data Fraud Examination Albrecht, 14 SH 2342 High ratio indicates that a firm is efficient in utilizing its assets or that the firm is operating on a cash basis (ibid) The number of days sales in account receivables is representing the average number of days that a company needs to collect its revenue from the customers It is usually called days sales outstanding ratio

Answered Calculate Activity Measures The Bartleby

Accounts Receivable Turnover Ratio Bestbussinesscircle

Days Sales Outstanding Formula Here is the DSO formula below Days Sales Outstanding Formula = Accounts Receivables Accounts Receivables Accounts receivables refer to the amount due on the customers for the credit sales of the products or services made by the company to them It appears as a current asset in the corporate balance sheet read more / Net Credit Sales * 365Days Sales Outstanding measures of the average number of days that a company takes to collect revenue after a sale has been made It is a financial ratio that illustrates how well a company's Accounts Receivable are being managed Paylocity Holding's Days Sales Outstanding for the three months ended in Mar 21 was 452A The number of days it takes to generate dollar sales equal to the outstanding accounts receivable balance B The number of days it would take to collect outstanding receivables if no new ones are created C

What Is Dso Why Dso Is Vital For Accounts Receivable Billtrust

Everything You Need To Know About Days Sales Outstanding

As a result, the accounts receivable turnover ratio is credit sales of $6,000,000 divided by the average amount of accounts receivable of $600,000 = 10 times a year This indicates that on average the company's accounts receivables turned over 10 times during the year, or approximately every 36 days (360 or 365 days per year divided by the Days Sales in Receivables The average number of days it takes to collect outstanding receivable amounts from customers Calculated as Number of Days in Period / Receivable Turnover NIKE, Inc (NKE) had Days Sales in Receivables of 26 for the most recently reported fiscal year, ending The ratio to determine number of days' sales in receivables is as follows (931) 365 Accounts Receivable Turnover Ratio The numerator is 365, the number of days in the year Because the accounts receivable turnover ratio determines an average accounts receivable figure, the outcome for the days' sales in receivables is also an average

Match The Ratio With The Formula A Days Sales In Chegg Com

Days Sales In Receivables Example Youtube

What Is Dso And Why Is It The Lifeline For Accounts Receivable Versapay

Slides Show

Ea9 9 3 Using The Following Select Financial Chegg Com

Days Sales Outstanding Average Collection Period Youtube

Why Dso Should Be A Focus Kpi For Your Company Intellichief

1

How To Improve Debtor S Receivable Turnover Ratio Collection Period

O Days Sales In Average Receivables Or Days Sales Chegg Com

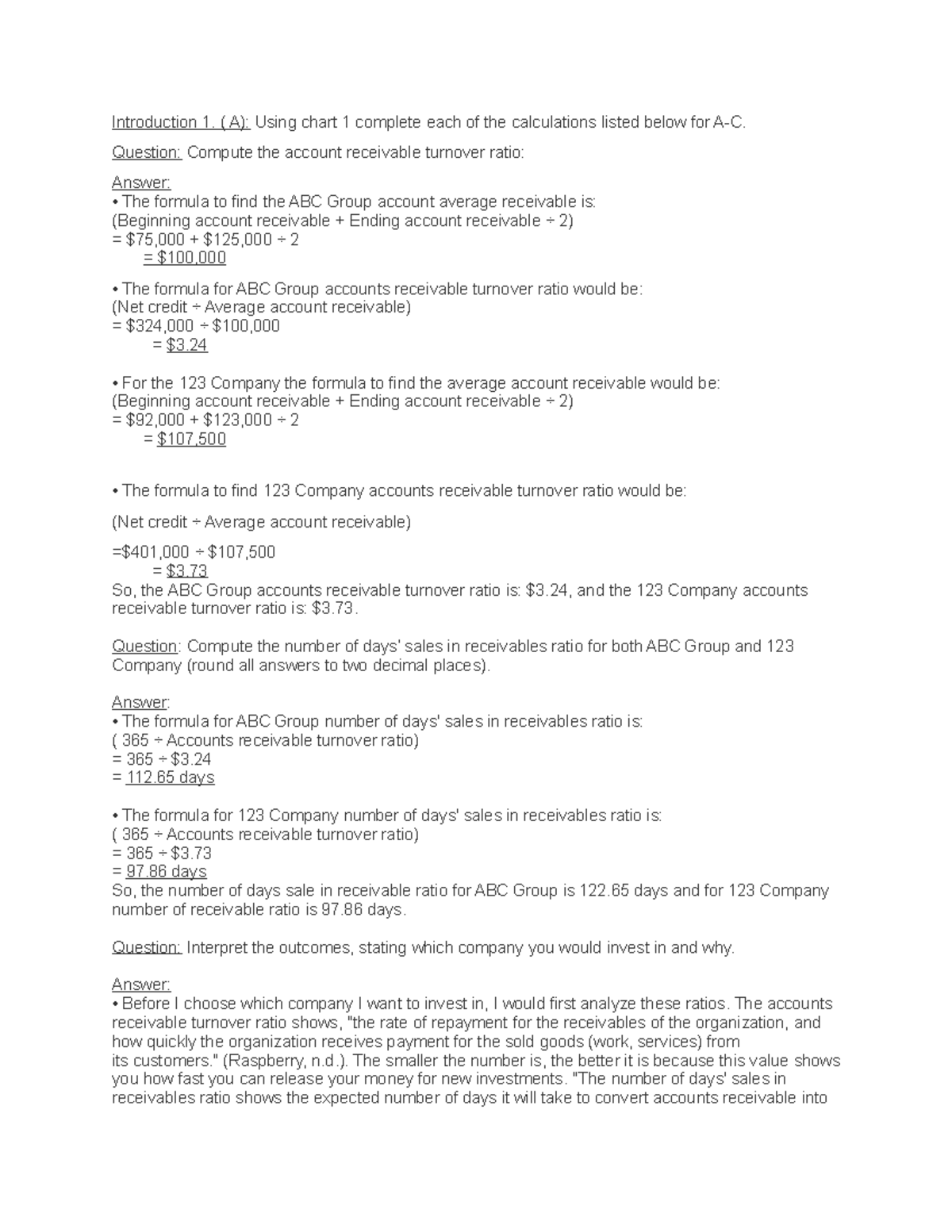

Learning Journal Unit 5 Bus1102 Studocu

1

Number Of Days Of Receivables Prepnuggets

Answered 1 Compute The Accounts Receivable Bartleby

Slides Show

Nobles Fin5 Ppt 15

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

Debtor Days Formula Calculator Excel Template

Measuring Days Sales Outstanding Dso Calculator

Days Sales Outstanding Template Download Free Excel Template

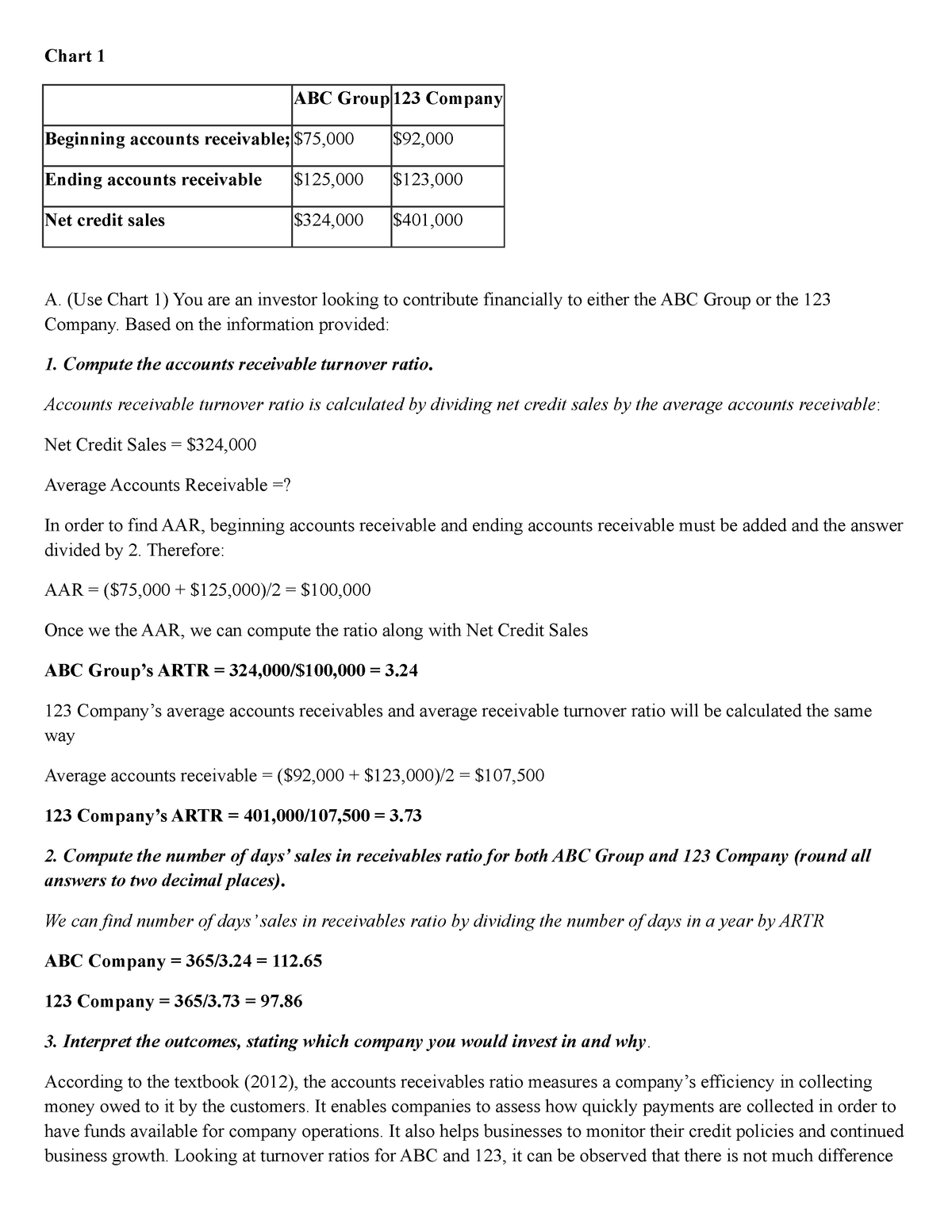

Solved Chart 1 Abc Group123 Companybeginning Accounts Receivable 75 000 92 000ending Accounts Receivable 125 000 123 000net Credit Sales 324 000 4 Course Hero

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

Accounts Receivable Turnover Ratio Meaning Formula

Accounts Receivable Turnover Ratio Formula Examples

What Is The Receivables Turnover Ratio Fourweekmba

Debtor Days Meaning Formula Calculate Debtor Days Ratio

Days Sales Outstanding Dso Definition Calculation And Formula Zoho Books

Days Sales Outstanding Dso Definition Formula Importance

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

Accounts Receivable Turnover Days

Financial Statement Analysis Ppt Download

Days Sales In Receivables Ratio Days Sales Outstanding Explained Formula Guidance Youtube

Accounts Receivable To Sales Ratio How To Calculate The Ratio

Measure And Manage Collection Efficiency Using Dso Abc Amega

Week 5 Learning Journal Financial Ratios Chart Abc Group 123 Company Studocu

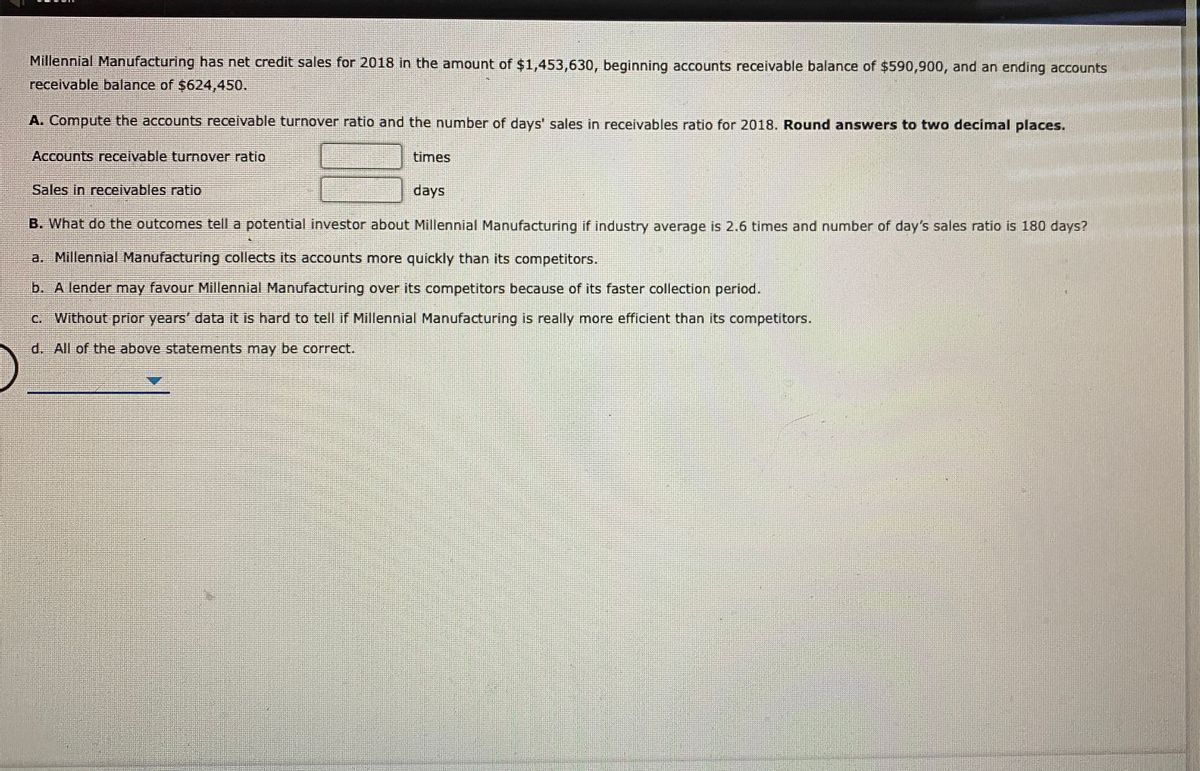

Answered Millennial Manufacturing Has Net Credit Bartleby

Chapter 8 Receivables 15 1 What Are Common

I Do Not Understand How The Accounts Receivable Chegg Com

A Better Way To Model Accounts Receivable And Accounts Payable By Dave Lishego Medium

Days Sales Outstanding Kpi Sense

Efficiency Ratio Days Sales In Receivables Or Days Sales Outstanding Youtube

Determine The Efficiency Of Receivables Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting

Days Sales Outstanding Meaning Formula Calculate Dso

Accounts Receivable Turnover Ratio Formula Examples

Days Sales Outstanding Calculator Plan Projections

Finance Ratio The Dso Calculation With Average Dso For The S P 500

Which Of The Following Is True Regarding The Receivables Turnover Ratio I It Measures The Average Homeworklib

Accounts Receivable Turnover And Days Sales In Chegg Com

Day Sales Outstanding Formula Calculator Scalefactor

Receivables Turnover Vs Days Sales Outstanding Dso What S The Difference Gaviti

Objective 5 Calculate The Acid Test Ratio And Days Sales In Receivables Ppt Download

What Is Days Sales In Receivables Ratio

Nobles Fin5 Ppt 15

9 Tips To Improve Your Accounts Receivable Turnover Enkel

Days Sales Outstanding Examples With Excel Template Advantages

Day S Sales Uncollected Formula Step By Step Calculation Examples

Accounts Receivable Turnover And Days Sales In Receivables Classic Company Designs Markets And Distributes A Variety Homeworklib

Accounts Receivable Turnover Ratio Bestbussinesscircle

Days Sales Outstanding Dso Ratio Formula Calculation

Ineventory Turnover And Days Sales In Inventory Ratios Youtube

Average Collection Period Formula Calculator Excel Template

Days Sales Outstanding Formula Meaning Example And Interpretation

Solved 8 Using The Following Select Financial Statement Chegg Com

What Is The Receivables Turnover Ratio Fourweekmba

Dso Calculation

Week 5 Learning Journal Studocu

Days Sales Outstanding Dso Definition

Continuing Company Analysis Amazon Accounts Receivable Turnover And Number Of Days Sales In Receivables Amazon Com Is One Homeworklib

Computing Days Sales In Receivables Youtube

Http Www Gleim Com Public Accounting Updates Cpa Bec 19 Updates Sept 19 Pdf

A Step By Step Guide To Calculating Days Sales Outstanding The Blueprint

Days Sales Uncollected Different Examples With Limitations

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

Days Sales Outstanding Define Formula Calculate Analysis Ideal Dso

Accounts Receivable Turnover And Days In Sales Receivable Financial Services Economies

What Is Days Sales Outstanding Dso Accountingcapital

Finance Ratio The Dso Calculation With Average Dso For The S P 500

Days Sales Outstanding Examples With Excel Template Advantages

Receivable Turnover Ratio Formula Calculate Interpretation Benchmark

O Days Sales In Average Receivables Or Days Sales Chegg Com

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

コメント

コメントを投稿